tucson sales tax rate 2019

The signing marks the second year in a row that hes accepted the GOPs comprehensive state government spending plan after vetoing budget bills in. For a complete list of charges please see your sales.

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Thats a nice bonus to add to the 26 federal solar tax credit which has no incentive cap and can be claimed over multiple years if necessary.

. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. Cost of Buying a. 2022 TUCSON Plug-in Hybrid.

The article explores the average cost of the different kind of manufactured homes as well as the cost of land. MSRP excludes freight charges tax title and license fees. Monday 800 AM 730 PM Tuesday 800 AM 730 PM Wednesday 800 AM 730 PM.

That will be down from Augusts record-high rate of 624 cents a fluctuation that comes as Indianas 7 sales tax on gasoline is calculated monthly along with a. Murders rapes robberies assaults burglaries thefts arson. The maximum local tax rate allowed.

Tucson Electric Power offers a rebate of up to 300 as a bill credit for residential charger installation. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. Finance charges may also be applied based on the type of loan you require.

As your full-service Ford dealership we have the new or used vehicle you need and we can beat those other prices. October 2019 CITY OF SOUTH TUCSON. Come to Royal Buick GMC in Tucson AZ for hassle-free pricing and a lifetime powertrain warranty with every new car.

Comparison of data from 2016 20172018 to 2019. You can also see the comparison of prices for new manufactured homes vs new single-family site-built homes and the average cost per square foot. 894 less than average US.

Vehicles displayed may contain optional equipment at additional cost. County rate of 1 percent city rate of 0 percent and special. Map Tucson AZ Today 830-7pm 520 407-3931.

This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. Reduced Vehicle License Tax and carpool lane access. On July 15 2019 the Mayor and the Council of the City.

33-mile All-Electric Range based on a fully charged battery pack. View our 7 Locations. These financing rates are only for gas-powered models.

Edmunds also provides consumer-driven dealership sales. Up to 1000 state tax credit Local and Utility Incentives. New 2022 threshold amounts for the retail sales and use tax two-level tax rate structure as approved by Phoenix voters with Proposition 104 in the August 25 2015 city elections will go into effect January 1 2022.

March 2019 cost of living index in Tucson. SRP and APS offer reduced electricity rates based on time-of-use charging for EV owners. A 60-month term is also available with a financing rate of 349 while a 72-month term is offered with a rate of 449.

Accessory items shown may vary according to model and illustration. Arizona solar tax credit. Prices do not include tax title dealer-installed accessories See individual brand site for brand-specific clarification or 489 doc fee.

Edmunds users rate the 2022 Tucson Hybrid 40 on a scale of 1 to 5 stars. Rates From 299 APR. Crime rate in Tucson detailed stats.

Texas has a statewide sales tax rate of 625 which has been in place since 1961. Hyundai Tucson Finance Deals. Freight charges and actual dealer prices may vary.

Select a 2022 gas-powered Tucson and you can finance your vehicle for as low as 299 for 48 months. Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. According to Sales Tax States in July 2019 the following Missouri cities experienced changes in their sales tax rates.

Electric Vehicles Solar and Energy Storage. Effective October 1 2019. Tax - General Sales and Gross ReceiptsProperty.

Municipal governments in Texas are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1684 for a total of 7934 when combined with the state sales tax. More 2022 Hyundai Tucson Hybrid Review. Average is 100 Tucson AZ residents houses and apartments details.

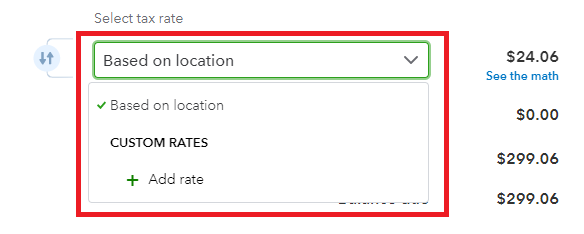

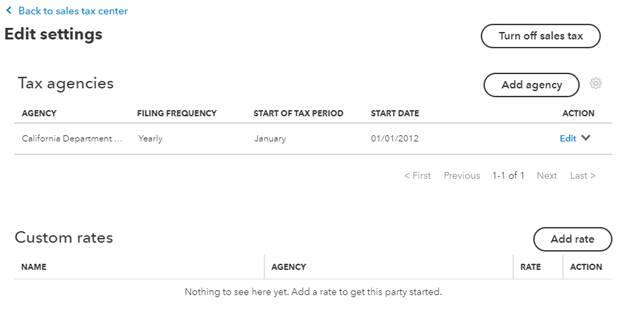

How To Process Sales Tax In Quickbooks Online

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Sales Tax Rates By City County 2022

Missouri Car Sales Tax Calculator

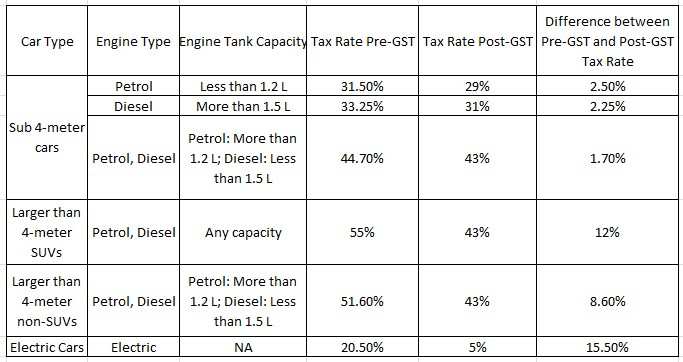

Auto Gst Rates What Are The Gst Rates On Automobiles In India Auto News Et Auto

How To Calculate Sales Tax For Your Online Store

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Sales Tax Guide And Calculator 2022 Taxjar

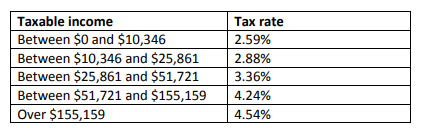

State And Local Taxes In Arizona Lexology

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

How To Process Sales Tax In Quickbooks Online

State And Local Taxes In Arizona Lexology

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation